Accountancy: 2018:CBSE:[Delhi]:Set -3

To Access the full content, Please Purchase

-

Q1

Distinguish between 'Dissolution of partnership' and 'Dissolution of partnership firm' on the basis of settlement of assets and liabilities.

Marks:1View AnswerAnswer:

Basis

Dissolution of Partnership

Dissolution of firm

Settlement of Assets and Liabilities

Assets and Liabilities are revalued and new balance sheet is drawn

Assets are sold off and Liabilities are paid off

-

Q2

Is 'Reserve Capital' a part of 'Unsubscribed Capital' or 'Uncalled Capital'?

Marks:1View AnswerAnswer:

Reserve Capital is a part of “Uncalled Capital”.

-

Q3

Ritesh and Hitesh are childhood friends. Ritesh is a consultant whereas Hitesh is an architect. They contributed equal amounts and purchased a building for ₹2 crores. After a year, they sold it for ₹3 crores and shared the profits equally. Are they doing the business in partnership? Give reason in support of your answer.

Marks:1View AnswerAnswer:

No, Ritesh and Hitesh are only co-owners of the property and are not in partnership. Partnership requires the partners to conduct a business on a regular basis and share the profits from the same.

-

Q4

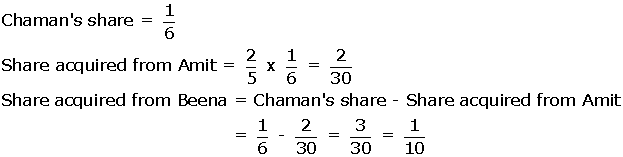

Amit and Beena were partners in a firm sharing profits and losses in the ratio of 3:1. Chaman was admitted as a new partner for 1/6thshare in the profits. Chaman acquired 2/5thof his share from Amit.

How much share did Chaman acquire from Beena?

Marks:1View AnswerAnswer:

-

Q5

Give the meaning of 'Debentures issued as Collateral Security'.

Marks:1View AnswerAnswer:

Issue of debentures as a collateral security means issue of debentures as an additional security, i.e., in addition to principal security. This type of additional security only can be realised when the principal security fail to cover amount of the loan.

For example, A company takes a loan of ₹1,00,000 from bank and gave a security but bank demand another security. In this condition company can issue debentures as a secondary security to bank, it will be known as Issue of debentures as a collateral security.

-

Q6

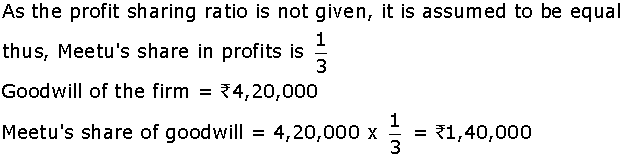

Neetu, Meetu and Teetu were partners in a firm. On 1 January, 2018, Meetu retired. On Meetu's retirement the goodwill of the firm was valued at ₹4,20,000.

Pass necessary journal entry for the treatment of goodwill on Meetu's retirement.

Marks:1View AnswerAnswer:

Journal (January 2018)

Date

Particulars

Dr. (₹)

Cr. (₹)

Jan 1

Neetu’s Capital A/c

Dr.

70,000

Teetu’s Capital A/c

Dr.

70,000

To Meetu’s Capital A/c

1,40,000

(Being goodwill adjusted in the ratio 1:1)

-

Q7

NK Ltd., a truck manufacturing company, is registered with an authorised capital of ₹1,00,00,000 divided into equity shares of ₹100 each. The subscribed and paid up capital of the company is ₹50,00,000. The company decided to open technical schools in the Jhalawar district of Rajasthan to train the especially abled children of the area. It is planning to provide them employment in its various production units and industries in the neighborhood area.

To meet the capital expenditure requirements of the project, the company offered 20,000 shares to the public for subscription. The shares were fully subscribed and paid.

Present the share capital in the Balance Sheet of the company as per the provisions of Schedule III of the Companies Act, 2013.

Also identify any two values that the company wants to communicate.

Marks:3View AnswerAnswer:

Balance Sheet of NK Ltd. (Extract)

as at

Particulars

Note. No.

Current Year Figures

₹

Previous Year Figures

₹

I. Equity and Liabilities

1. Shareholder’s Funds

a) Share Capital

(1)

70,00,000

50,00,000

Total

70,00,000

50,00,000

Notes To Accounts:

Note. No.

Particulars

₹

1

Share Capital

Authorised Share Capital

1,00,000 Equity Shares of ₹100 each

1,00,00,000

Issued Share Capital

70,000 Equity Shares of ₹100 each

70,00,000

Subscribed and Fully Paid up Capital

70,000 Equity Shares of ₹100 each, fully-called up

70,00,000

Values involved are:

1) Concern for the differently abled children

2) Employment generation

-

Q8

What is meant by a ‘Share’? Give any two differences between 'Preference Shares' and 'Equity Shares'.

Marks:3View AnswerAnswer:

Total capital of the company is divided into units of small denominations. Each such unit is called ‘Share’.

Basis of difference

Preference Shares

Equity Shares

Rate of Dividend

Preference Shares are paid dividend at a fixed rate.

The rate of dividend on equity shares is not fixed. It may vary from year to year depending upon the availability of profits.

Voting Rights

Preference Shareholder do not have any voting rights.

Equity Shareholder enjoy voting rights.

-

Q9

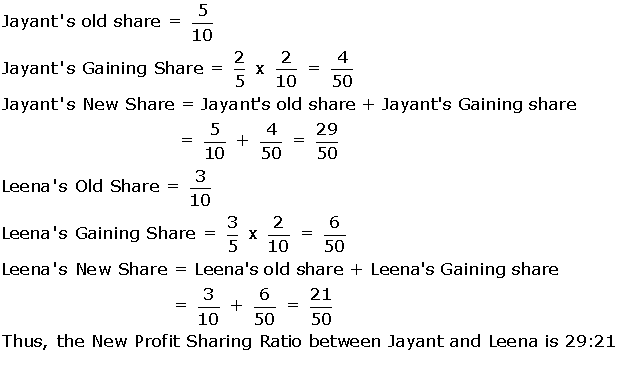

Jayant, Kartik and Leena were partners in a firm sharing profits and losses in the ratio of 5:2:3. Kartik died and

Jayant and Leena decided to continue the business. Their gaining ratio was 2:3.

Calculate the new profit sharing ratio of Jayant and Leela.

Marks:3View AnswerAnswer:

-

Q10

Complete the following journal entries left blank in the books of VK Ltd.:

VK Ltd. Journal

Date

Particulars

L.F.

Dr. (₹)

Cr. (₹)

2018

………….

Dr.

…………

Feb 01

………….

………..

(Purchased own 500, 9% debentures of ₹100 each at ₹97 each for immediate cancellation)

Feb 01

………….

Dr.

………….

…………

…………

………..

………..

(Cancelled own debentures)

………..

………….

Dr.

…………

………….

……….

(……………………….)

Marks:3View AnswerAnswer:

Books of VK Ltd.

Journal

Date

Particulars

L.F.

Dr. ₹

Cr. ₹

2018

Feb 1

Own Debentures A/c

Dr.

48,500

To Cash/Bank A/c

48,500

(Purchased own 500, 9% debentures of ₹100 each at ₹97 each for immediate cancellation)

Feb 1

9% Debentures A/c

Dr.

50,000

To Own Debentures A/c

48,500

To Gain on Cancellation of own debentures A/c

1,500

(Cancelled own debentures)

Mar 31

Gain on cancellation of own debentures

Dr.

1,500

To Capital Reserve

1,500

(Gain on cancellation transferred to Capital Reserve)