Accountancy: 2019: CBSE: [All India]: Set – I

To Access the full content, Please Purchase

-

Q1

Pass the necessary journal entry for treatment of Partner's loan appearing on the asset side of the Balance Sheet in case of dissolution of a partnership firm.

Marks:1View AnswerAnswer:

Books of journal

Date

Particulars

L.F.

Dr. ₹

Cr. ₹

Partner’s Capital A/c

Dr.

To Partner’s Loan A/c

(Being Partner’s Loan account transferred to Partner’s capital Account)

-

Q2

A new partner acquires two main rights in the partnership firm which he joins. State one of these rights.

Marks:1View AnswerAnswer:

One of the rights of a new partner joining the firm is a right to have a share the assets of the partnership firm.

-

Q3

How does 'Nature of business' affect the value of goodwill of a firm?

Marks:1View AnswerAnswer:

If the business of a firm is of the nature where the products dealt in are in high demand although not short in supply, the profit will be higher. It will, thus, increase the value of its goodwill.

-

Q4

State the main aim of a not-for-profit organisation.

Marks:1View AnswerAnswer:

Not-for-organisation, is set-up with a purpose to further cultural, educational, religious, and professional or public service.

-

Q5

How is 'Life membership fee' treated while preparing the financial statements of a not-for-profit organization?

Marks:1View AnswerAnswer:

Life Membership Fee is accounted as a capital receipt and added to Capital Fund on the liabilities side of the balance sheet. It is not accounted as income because a life membership makes one-time payment and avails services all through his life.

-

Q6

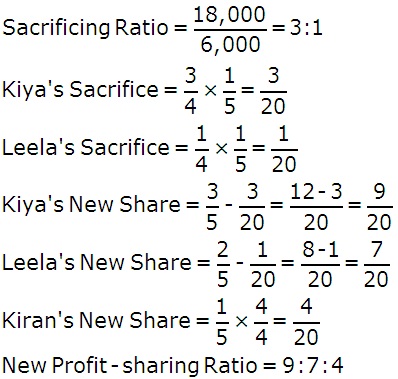

Kiya and Leela are partners sharing profits in the ratio 3:2. Kiran was admitted as a new partner with 1/5th share in the profits and brought ₹24,000 as her share of goodwill premium that was credited to the capital accounts of Kiya and Leela respectively with ₹18,000 and ₹6,000.

Calculate the new profit sharing ratio of Kiya, Leela and Kiran.Marks:1View AnswerAnswer:

Goodwill premium brought by Kiran = ₹24,000

Goodwill is credited to the sacrificing partners in their Sacrificing Ratio

Kiya’s share of goodwill = ₹18,000

Leela’s share of goodwill = ₹6,000

-

Q7

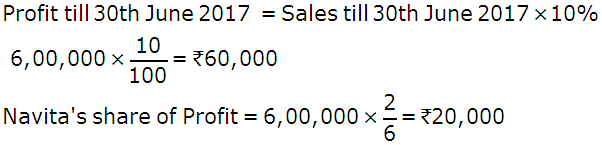

Dinakar, Navita and Vani were partners sharing profits and losses in the ratio of 3:2:1. Navita died on 30th June, 2017. Her share of profit for the intervening period was based on the sales during that period, which were ₹6,00,000. The rate of profit during the past four years had been 10% on sales.

The firm closes its books on 31st March every year.

Calculate Navita's share of profit.Marks:1View AnswerAnswer:

-

Q8

What is meant by 'Private Placement of Shares'?

Marks:1View AnswerAnswer:

Private placement of shares means issue and allotment of shares to a select group of persons (individuals and companies) privately and not to the public in general through public areas.

-

Q9

What is meant by 'Reserve Capital'?

Marks:1View AnswerAnswer:

Reserve Capital is the part of uncalled capital which cannot be called-up except in the event of winding up.

-

Q10

Average profits of a firm during the last few years are ₹80,000 and the normal rate of return in a similar business is 10%. If the goodwill of the firm is ₹1,00,000 at 4 years' purchase of super profit, find the capital employed by the firm.

Marks:3View AnswerAnswer:

Goodwill of firm = Super Profit x Number of years purchase

₹1,00,000 = Super Profit x 4

Super Profit = ₹1,00,000 /4 = ₹25,000

Super Profit = Average Profit – Normal Profit

₹25,000 = ₹80,000 – Normal Profit

Normal Profit = ₹55,000

Normal Profit = Capital Employed x Normal Rate of Return

₹55,000 = Capital Employed x 10/100

Capital employed = ₹55,000 x 100/10 = ₹5,50,000