Accountancy: 2019:CBSE:[Delhi]:Set -1

To Access the full content, Please Purchase

-

Q1

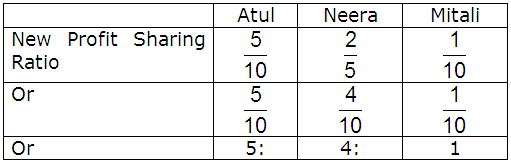

Atul and Neena were partners in a firm sharing profits in the ratio 3:2. They admitted Mitali as a new partner. Goodwill of the firm was valued ₹2,00,000. Mitali brings her share of goodwill premium of ₹20,000 in cash, which is entirely credited to Atul's Capital Account. Calculate the new profit sharing ratio.

Marks:1View AnswerAnswer:

Revalued Goodwill of the firm on Mitali's admission

= ₹2,00,000

Premium for Goodwill brought in cash by Mitali = ₹20,000

So, Mitali's share in future profit of the firm =

Atul's Account has only been credited by the premium brought in by Mitali.

So, Atul's Sacrificing Share = Profit Share of Mitali =

New Profit Share of Atul =

Hence,

-

Q2

What is meant by 'Issued Capital'?

Marks:1View AnswerAnswer:

As per Section 2(50) of the Companies Act 2013, Issued capital means such capital as the company issues from time to time for subscription.

Issued capital is a part of Authorised capital that is issued for subscription.

It includes besides shares issued for subscription, shares allotted for consideration other than cash, shares subscribed by signatories to the memorandum of Association and shares taken by directors as qualifying shares.

-

Q3

What is meant by 'Employees Stock Option Plan'?

Marks:1View AnswerAnswer:

Employee Stock Option means option granted by the company to its employees and employee directors to subscribe the shares at a price that is lower than the market price, i.e., fair value.

It is a right granted by the company but it is not an obligation on the employee to subscribe it. -

Q4

State any two situations when a partnership firm can be compulsorily dissolved.

Marks:1View AnswerAnswer:

Following are two situations when a partnership firm can be compulsorily dissolved.

- When business of the firm becomes unlawful.

- When all the partners or all the partners except one become insolvent.

-

Q5

What is meant by 'Gaining Ratio' on retirement of a partner?

Marks:1View AnswerAnswer:

The ratio in which the continuing partners acquire the outgoing (retired or deceased) partner’s share is called the Gaining Ratio.

Algebraically,

Gaining Ratio = New Profit Sharing Ratio - Old Profit Sharing Ratio.

Calculation of gaining ratio is necessary for adjusting the retiring partner’s share of goodwill.

Remaining partners will compensate the outgoing partner by payment of premium for goodwill in their gaining ratio.

-

Q6

P, Q, and R were partners in a firm. On 31st March, 2018 R retired. The amount payable to R ₹2,17,000 was transferred to his loan account. R agreed to receive interest on this amount as per the provisions of Partnership Act, 1932. State the rate at which interest will be paid to R.

Marks:1View AnswerAnswer:

If any partner gives loan to the firm, R is entitled to receive interest at the agreed rate of interest and specified in the Partnership Deed.

In the absence of a Partnership Deed, provisions of Indian Partnership Act, 1932 will apply than R would be given interest @ 6% per annum. -

Q7

Chhavi and Neha were partners in a firm sharing profits and losses equally. Chhavi withdrew a fixed amount at the beginning of each quarter. Interest on drawings is charged @ 6% p.a. At the end of the year, interest on Chhavi's drawings amounted to ₹900. Pass necessary journal entry for charging interest on drawings.

Marks:1View AnswerAnswer:

Particulars

L.F.

Dr. ₹

Cr. ₹

Chhavi's Capital A/c

Dr.

900

To Interest on Drawings A/c

900

(For interest on drawings charged)

Interest on Drawings A/c

Dr.

900

To Profit & Loss Appropriation A/c

900

(For interest on drawings transferred to profit & loss account)

-

Q8

How are Specific donations treated while preparing final accounts of a 'Not-For-Profit Organisations’?

Marks:1View AnswerAnswer:

In case the donor specifies the purpose for which the donation can be used, it is a Specific Donation.

Specific donation is capitalised and is shown on the liabilities side of the Balance sheet. -

Q9

State the basis of accounting of preparing 'Income and Expenditure Account' of a Not-For-Organisation.

Marks:1View AnswerAnswer:

Not-for-Profit organisations are not established for the purpose of earning profit, they prepare Income and Expenditure Account instead of Profit and Loss Account.

Income and Expenditure Account is prepared at the end of the accounting period matching revenue expenses with revenue receipts (income) to determine surplus or deficit and it is prepared following accrual basis of accounting. -

Q10

Garvit Ltd. invited applications for issuing 3,000, 11% Debentures of ₹100 each at a discount of 6%. The full amount was payable on application. Applications were received for 3,600 debentures. Applications for 600 debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applicants. Pass the necessary journal entries for the above transactions in the books of Garvit ltd.

Marks:3View AnswerAnswer:

Particulars

L.F.

Dr. ₹

Cr. ₹

Bank A/c (₹94 x ₹3,600)

Dr.

3,38,400

To Debenture Application & Allotment A/c

3,38,400

(For application money received on 3,600 debentures at a discount of 6%)

Debenture Application & Allotment A/c

Dr.

3,38,400

Discount on issue of Debenture A/c

Dr.

18,000

To 11% Debentures A/c

3,00,000

To Bank a/c (₹94 x 600)

56,400

(For application money transferred to 11% Debentures and excess refunded)