Accountancy : Company Accounts and Analysis of Financial Statements 2011 CBSE [ All India ] Set II

To Access the full content, Please Purchase

-

Q1

Give the average period in months for charging interest on drawings for the same amount withdrawn at the beginning of each quarter.

Marks:1View AnswerAnswer:

7.5 months

-

Q2

What is the basis for preparing Receipt and Payment Account?

Marks:1View AnswerAnswer:

Cash basis

-

Q3

State the meaning of sacrificing ratio.

Marks:1View AnswerAnswer:

The ratio in which some partners sacrifice their ratio in favour of other partner is called sacrificing ratio.

-

Q4

Give the meaning of ‘Issue of Debentures as a collateral security’.

Marks:1View AnswerAnswer:

‘Issue of Debentures as a collateral security’ refers to issue of debentures as a secondary security along with principal security for raising loan.

-

Q5

How does the nature of business affect the value of goodwill of a firm?

Marks:1View AnswerAnswer:

The firm producing products, having stable demand will be able to earn more profits and more goodwill.

-

Q6

Goodluck Ltd. purchased machinery costing Rs. 10,00,000 from Fair Deals Ltd. The company paid the price by issue of Equity shares of Rs. 10 each at a premium of 25%.

Pass necessary journal entries for the above transactions in the books of Goodluck Ltd.Marks:3View AnswerAnswer:

Journal of Goodluck Ltd.

Date

Particulars

Dr.

Cr.

Machinery Dr.

10,00,000

To Fair Deals Ltd.

10,00,000

(Being machinery purchased)

Fair Deals Ltd. Dr.

10,00,000

To Equity Share Capital A/c

8,00,000

To Securities Premium A/c

2,00,000

(Being the issue of 80,000 fully paid equity shares at a premium of 25%)

Working Note:

Number of Equity Shares to be issued=Purchase Price/Issue Price of Share

=10,00,000/12.5

=80,000 shares -

Q7

X Ltd. redeemed 1,000 6% Debentures of Rs. 100 each by converting them into Equity shares of Rs. 100 each. The 6% Debentures were redeemable at a premium of 5% for which the Equity shares were issued at a premium of 25%. Pass the necessary journal entries for the redemption of the above mentioned Debentures in the books of X Ltd.

Marks:3View AnswerAnswer:

Journal of X Ltd.

Date

Particulars

Dr.

Cr.

6% Debentures A/c Dr.

1,00,000

Premium on Redemption

of Deb. A/c Dr.

5,000

To Debenture holders A/c

1,05,000

(Being debentures due for redemption)

Debentures holders A/c Dr.

1,05,000

To Equity Share Capital A/c

84,000

To Securities Premium A/c

21,000

(Being equity shares issued at a premium of 25% in conversion of Debentures)

Working Note: Number of Equity Shares to be issued

= Amount Payable/Issue Price of Share

=1,05,000/125=840 shares -

Q8

From the following information of a club, show the amounts of Prize awarded & Prize fund in the Financial Statements of the club for the year ended on 31st March 2009 and 31st March 2010:

Details

Rs.

Prize Fund as on 1.4.2009

20,000

Prize Fund donations received during the year 2009-2010

40,000

Prizes awarded during the year 2009-2010

69,000

Marks:3View AnswerAnswer:

Balance Sheet (As on 31st March 2009)

Liabilities

Amount

Assets

Amount

Prize Fund

20,000

Balance Sheet (As on 31st March 2010)

Liabilities

Amount

Assets

Amount

Prize Fund

20,000

Nil

Add: Donation for fund

40,000

60,000

Less: Prize awarded

60,000

Income & Expenditure Account

Dr. (for the year ended 31st March,2010) Cr.

Expenditure

Amount

Income

Amount

To Prize Awarded (69,000-60,000)

9,000

-

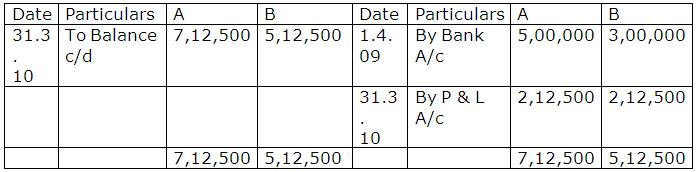

Q9

A and B entered into partnership on 1st April 2009 without any partnership deed. They introduced capitals of Rs. 5,00,000 and Rs. 3,00,000 respectively. On 31st October 2009, A advanced Rs. 2,00,000 by way of loan to the firm without any agreement as to interest.

The Profit and Loss Account for the year ended 31.3.2010 showed a profit of Rs. 4,30,000 but the partners could not agree upon the amount of interest on loan to be charged and basis of division of profits. Pass a journal entry for the distribution of the profits between the partners and prepare the Capital A/c of both the partners and Loan A/c of ‘A’.Marks:4View AnswerAnswer:

Dr. Profit and Loss Appropriation A/c Cr.

Particulars

Amount

Particulars

Amount

To A’s Capital

2,12,500

By Net Profit (4,30,000-5000)

4,25,000

To B’s Capital

2,12,500

4,25,000

4,25,000

Dr. Partners Capital A/c Cr.

Journal Entry

Date

Particulars

Dr.

Cr.

31.3.

10

Profit & Loss Appropriation A/c Dr.

4,25,000

To A’s Capital A/c

2,12,500

To B’s Capital A/c

2,12,500

(Being profit distributed among the partners)

Dr. A’s Loan A/c Cr.

Date

Particulars

Amount

Date

Particulars

Amount

31.3.

10

To Balance c/d

2,05,000

31.10.

10

By Bank A/c

2,00,000

31.3.

10

By Int. on

Loan

5,000

2,05,000

2,05,000

-

Q10

Pass the necessary journal entries for the issue and redemption of debentures in the following cases:

(i) 15,000, 9% Debentures of Rs. 250 each issued at 5% premium, repayable at 15% premium.

(ii) 2,00,000, 12% Debentures of Rs. 10 each issued at 8% premium, repayable at par.Marks:4View AnswerAnswer:

(i) Journal

S. N.

Particulars

Dr.

Cr.

1

Bank A/c Dr.

39,37,500

To 9% Debentures App. &

Allot. A/c

39,37,500

(Being application money received)

2

9% Debenture App. & Allot. Dr.

39,37,500

Loss on Issue of Deb. A/c Dr.

5,62,500

To 9% Debentures A/c

37,50,000

To Securities Premium A/c

1,87,500

To Premium on Redemption

of Debenture A/c

5,62,500

(Being application money transferred)

3

9% Debentures A/c Dr.

37,50,000

Prem. On Red. Of Deb. A/c Dr.

5,62,500

To Debenture holders A/c

43,12,500

(Being deb. Due for redemption)

4

Debenture holders A/c Dr.

43,12,500

To Bank A/c

43,12,500

(Being amount paid to debenture holders)

(ii) Journal

1

Bank A/c Dr.

21,60,000

To Deb. App. & Allot A/c

21,60,000

(Being application money received)

2

Deb. App. & Allot. A/c Dr.

21,60,000

To 12% Debentures A/c

20,00,000

To Securities Premium A/c

1,60,000

(Being application money received including premium)

3

12% Debentures A/c Dr.

20,00,000

To Debentureholders A/c

20,00,000

(Being debentures due for redemption)

4

Debentureholders A/c Dr.

20,00,000

To Bank A/c

20,00,000

(Being amount paid to debenture holders)