Accountancy : Company Accounts and Analysis of Financial Statements 2013 CBSE [ All India ] Set 2

To Access the full content, Please Purchase

-

Q1

What is meant by ‘issue of debentures as collateral security’?

Marks:1View AnswerAnswer:

When the company issues debentures as a secondary security in addition to the primary security against a bank loan or overdraft, then such issue of deb. is known as issue of deb. as collateral security.

-

Q2

At what rate is interest paid by the company on calls-in-advance, if it has not prepared its own Articles of Association?

Marks:1View AnswerAnswer:

Interest on Calls-in-advance is paid @ 6% p.a. as per Table A of Companies Act, if it is not mentioned in Articles of Association.

-

Q3

Give the Journal entry to distribute ‘Workmen Compensation Reserve’ of

70,000 at the time of retirement of Neeti when there is a claim of

70,000 at the time of retirement of Neeti when there is a claim of  25,000 against it. The Firm has three partners Raveena, Neeti and Rajat.Marks:1View Answer

25,000 against it. The Firm has three partners Raveena, Neeti and Rajat.Marks:1View AnswerAnswer:

Journal

Date

Particulars

L.F.

Dr. (

)

)Cr. (

)

)Workmen Compensation Reserve A/c

Dr.

70,000

To Workmen Compensation Claim

25,000

To Raveena’s Cap. A/c

15,000

To Neeti’s Capital A/c

15,000

To Rajat’s Capital A/c

15,000

(Being workmen compensation claim adjusted through workmen compensation reserve and the balance distributed among partners)

-

Q4

What is meant by ‘Calls-in-Arrears’?

Marks:1View AnswerAnswer:

When any shareholder does not make the payment of any amount due from him either on allotment or on any call, then the amount not paid is called Calls-in-Arrears.

-

Q5

At what rate is interest payable on the amount remaining unpaid to the executor of deceased partner?

Marks:1View AnswerAnswer:

The interest payable @ 6% p.a. unless agreed otherwise, on the unpaid amount to deceased partner’s executor.

-

Q6

State the ratio in which the partners share the accumulated profits when there is a change in the profit sharing ratio amongst existing partners.

Marks:1View AnswerAnswer:

At the time of change in profit sharing ratio of existing partners, any accumulated profits and reserves are distributed in their old profit sharing ratio so that the partners should not be placed at an advantage or disadvantage.

-

Q7

If the partners’ capitals are fixed, where will you record the interest charged on drawings?

Marks:1View AnswerAnswer:

When Partners Capitals are fixed, then the interest on drawings will be recorded first on the credit side of P&L Appropriation A/c and then on the debit side of Partner’s Current A/c.

-

Q8

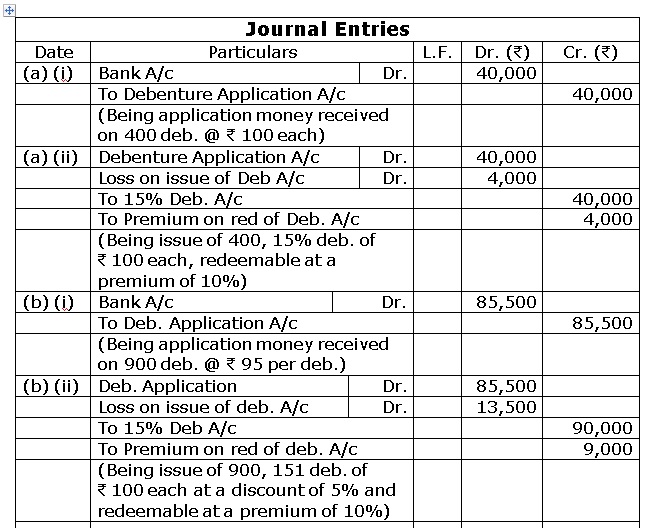

Pass the necessary Journal entries for the issue of debentures in the following cases:

(a) 40,000, 15% Debentures of

40,000, 15% Debentures of  100 each issued at par redeemable at 10% premium.

100 each issued at par redeemable at 10% premium.

(b) 90,000, 15% Debentures of

90,000, 15% Debentures of  100 each issued at a discount of 5% redeemable at premium of 10%.Marks:3View Answer

100 each issued at a discount of 5% redeemable at premium of 10%.Marks:3View AnswerAnswer:

-

Q9

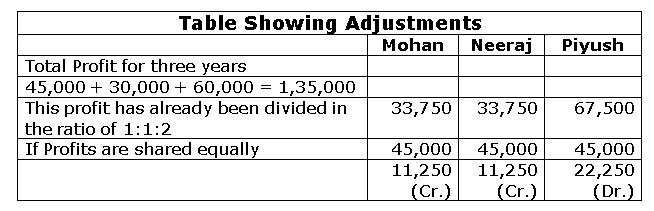

Mohan, Neeraj and Piyush are partners in a firm. They contributed

75,000 each as capital three years ago. At that time Piyush agreed to look after the business as Mohan and Neeraj were busy. The profits for the past three years were

75,000 each as capital three years ago. At that time Piyush agreed to look after the business as Mohan and Neeraj were busy. The profits for the past three years were  45,000,

45,000,  30,000 and

30,000 and  60,000 respectively. While going through the books of accounts, Mohan noticed that profit had been distributed in 1:1:2 ratio.

60,000 respectively. While going through the books of accounts, Mohan noticed that profit had been distributed in 1:1:2 ratio. When he enquired from Piyush about this, Piyush answered that since he looked after the business he should get more profit. Mohan disagreed and it was decided to distributed profits equally with retrospective effect for the last three years.

(a) You are required to make necessary corrections in the books of accounts of Mohan, Neeraj and Piyush by passing an adjustment entry.

(b) Identify the value which is being ignored by Piyush.Marks:3View AnswerAnswer:

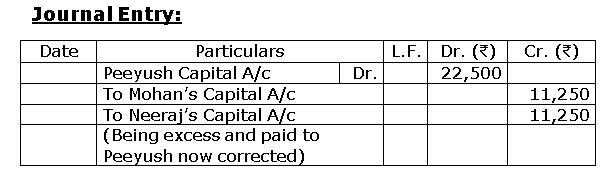

It is clear from the above table that Piyush had received

67,500 whereas he should have received

67,500 whereas he should have received  45,000 only. Therefore, he will surrender

45,000 only. Therefore, he will surrender  11,250 each in favour of Mohan and Neeraj.

11,250 each in favour of Mohan and Neeraj.

Followings values were ignored by the act of piyush;

· Honesty

· Mutual trust.

-

Q10

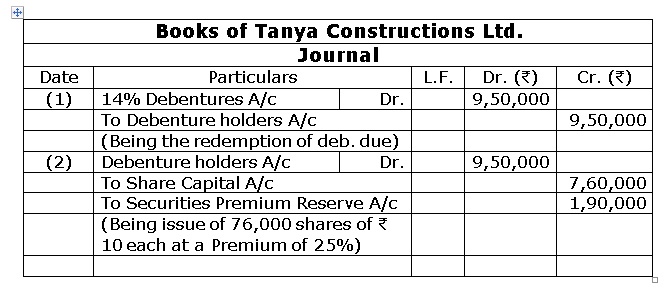

Tanya Constructions Ltd. had an outstanding balance of

19,00,000, 14% debentures of

19,00,000, 14% debentures of  100 each redeemable at par. According to the terms of redemption, the company redeemed 50% of the above debentures by converting them into shares of

100 each redeemable at par. According to the terms of redemption, the company redeemed 50% of the above debentures by converting them into shares of  10 each at a premium of 25%.

10 each at a premium of 25%. Record the entries for redemption of Debentures in the books of Tanya Constructions Ltd.

Marks:3View AnswerAnswer:

Working Notes: